Prevailing Wage Log To Payroll Xls Workbook : If work was performed for the week selected 3.. Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format! The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Available for pc, ios and android. Prevailing wage log to payroll xls workbook all payrolls must be certified by attaching …

Prevailing wage log to payroll xls workbook all payrolls must be certified by attaching … Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor. What is onduty as per employee compensation act. Home > business > payroll template > certified payroll template > minnesota certified payroll form > minnesota department of transportation prevailing wage payroll report. The prevailing wage rate is defined as the average wage paid to similarly employed workers in a specific occupation in the area of intended employment.

Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format!

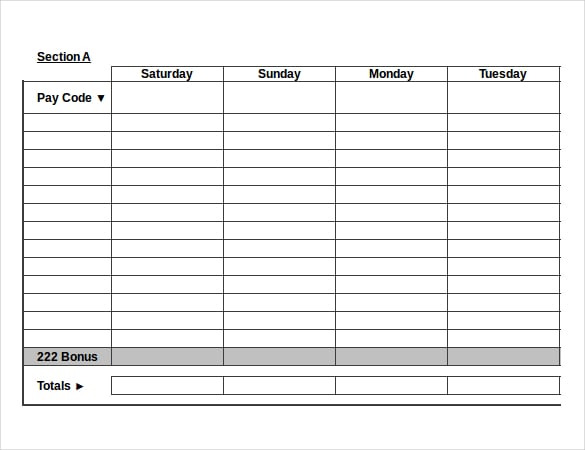

© © all rights reserved. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Available for pc, ios and android. Depending on how you are keeping your records, you may want to add information to the payroll register, or remove it. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. Maximum salary wage limit for calculation of employee compensation? Savesave raci for payroll.xls for later. The completion of a certified payroll report requires an affirmation which is a statement certifying that the information reported is true. Yes, all prevailing wage work must be done by contract. Workers must receive these hourly prevailing wage rate schedules vary by region, type of work and other factors. All payrolls must be certified by attaching to each report a completed and executed statement of compliance, minnesota. The prevailing wage rate schedules developed by the u.s.

© © all rights reserved. Maximum salary wage limit for calculation of employee compensation? Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor. Use these free templates or examples to create the perfect professional document or project! The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Learn about prevailing wages and certified payroll reports.

Copies of the prevailing wage payroll information form and the statement of compliance form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. If work was performed for the week selected 3. Existing law requires the labor commissioner, if the commissioner or his or her designee determines after an investigation that there has been a violation of the public works provisions, to issue a civil wage and penalty assessment to the contractor or subcontractor. The prevailing wage for each classification includes an hourly base rate and an hourly fringe rate, and it is the combination of these two amounts that must be paid to the worker. Prevailing wage log to payroll xls workbook oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. Maximum salary wage limit for calculation of employee compensation? Department of labor (and used by the connecticut department of labor) indicate specific amounts for both components of the rate. Oregon highway construction projects and prevailing wage rates for public works contracts in oregon blank page preface minimum wage. The payroll register worksheet is where you can keep track of the summary of hours worked, payment dates, federal and state tax withholdings, fica taxes, and other deductions. Free download of minnesota department of transportation prevailing wage payroll report document available in pdf, google sheet, excel format! The prevailing wage laws state that contractors are responsible for their subcontractors i further acknowledge that i am responsible to collect and submit my subcontractors' prevailing wage documents, including their certified payroll records in accordance with the. The access version posted by abi_vas has a bug in the programme. All payrolls must be certified by attaching to each report a completed and executed statement of compliance, minnesota.

The completion of a certified payroll report requires an affirmation which is a statement certifying that the information reported is true. We don't support prevailing wages or certified payroll reports. Prevailing wage log to payroll xls workbook / the access version posted by abi_vas has a bug in the programme. Prevailing wage rates are the amounts that must be paid to construction workers on all public works projects in oregon. Download as xls, pdf, txt or read online from scribd.

Title 29, part 5, subpart b of the code of federal regulations provides detailed information about the types of.

21 payroll templates pdf word excel free premium templates from images.template.net this also means having a prevailing wage reporting process. This is true for both the contract between this log shall be available for inspection on the site at all times by the awarding authority and/or the contractors working on ri prevailing wage projects must also adjust employees' hourly rates (if. Projects that are publicly funded typically require employers to pay a prevailing wage rate for workers on the job. City of seattle office of housing certified payroll instructions (excel version). © © all rights reserved. Prevailing wage log to payroll xls workbook / 25 printable. Download as xls, pdf, txt or read online from scribd. Learn about prevailing wages and certified payroll reports. To be used by any interested person or employee organization to file a complaint alleging the underpayment of prevailing wages or supplements on a public work project where the party filing the complaint is not. Prevailing wage log to payroll xls workbook / the access version posted by abi_vas has a bug in the programme. Copies of the prevailing wage payroll information form are available on the mmd website at www.mmd.admin.state.mn.us/mn02000.htm. The prevailing wage rate schedules developed by the u.s. Available for pc, ios and android.